Fica And Medicare 2025 - Fica And Medicare Rates 2025 Riva Verine, 29 rows tax rates for each social security trust fund. Fica And Medicare 2025. The social security wage base has increased from $160,200 to $168,600 for 2025, which increases. Learn precise tax calculation examples and stay compliant to avoid penalties

Fica And Medicare Rates 2025 Riva Verine, 29 rows tax rates for each social security trust fund.

Calculate fica and medicare withholding IanAnnaleigh, Learn precise tax calculation examples and stay compliant to avoid penalties

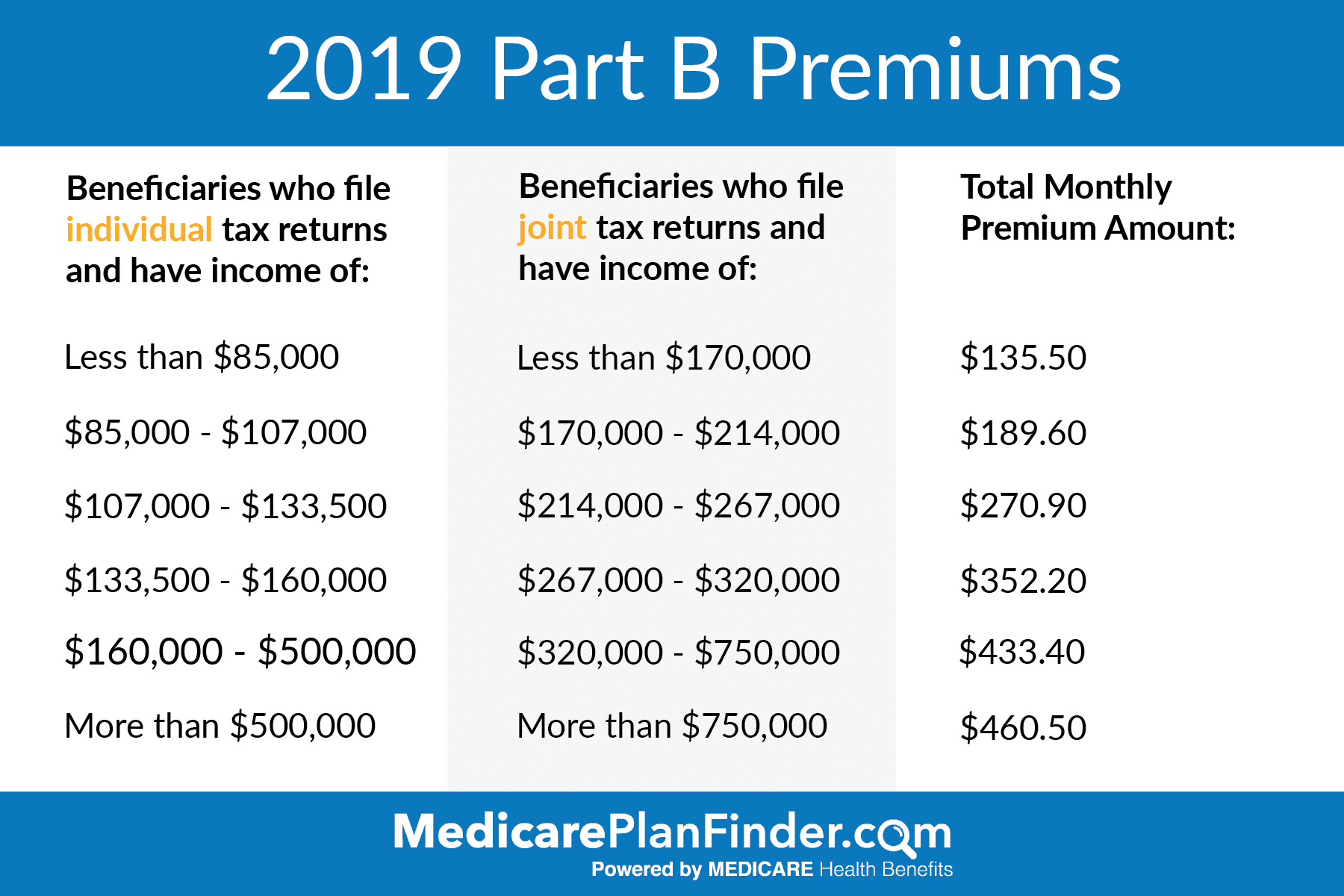

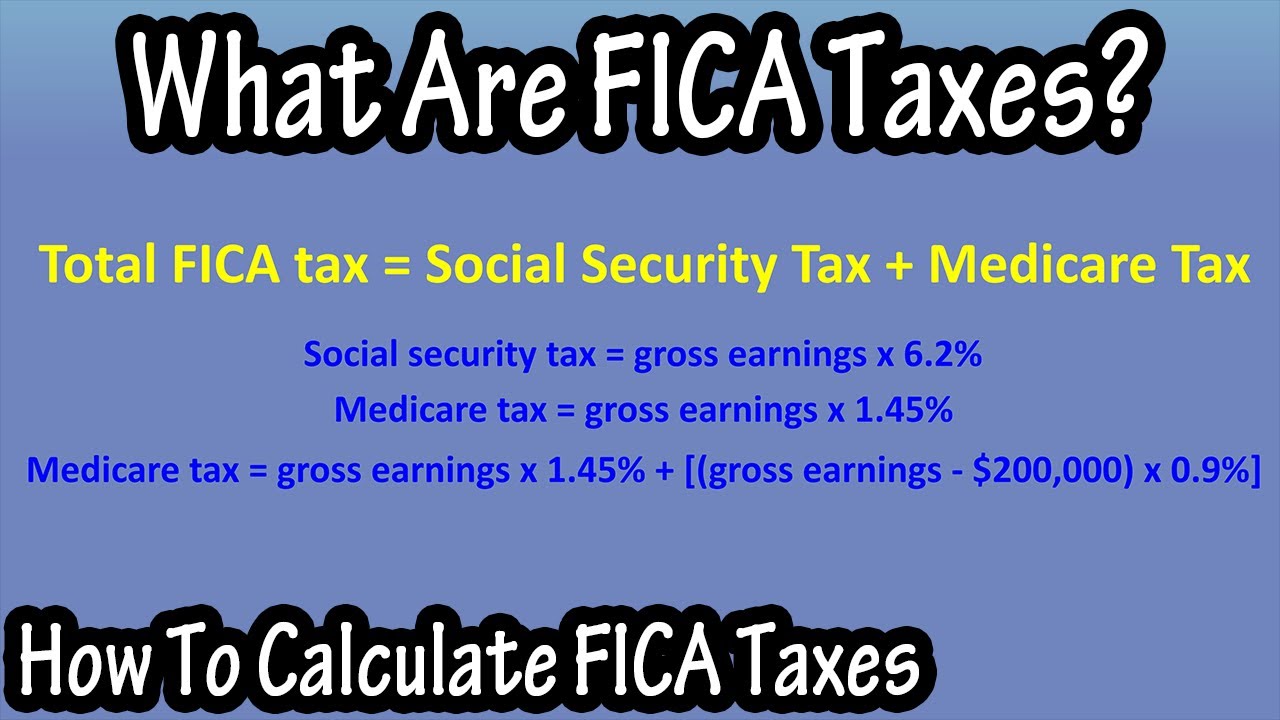

Medicare A And B Cost 2025 Ellyn Hillary, The fica tax rate, which is the combined social security rate of 6.2 percent and the medicare rate of 1.45 percent, remains 7.65 percent for 2025 (or 8.55 percent.

Employer Fica And Medicare Rates 2025 Chart Nelle Yalonda, Fica tax, which stands for the federal insurance contributions act tax, is a crucial aspect of the u.s.

Employer Fica And Medicare Rates 2025 Calendar Natty Viviana, For tax year 2025, that limit is $168,600.

What Is And How To Calculate FICA Taxes Explained, Social Security, The maximum fica tax rate for 2025 is 6.2%.

:max_bytes(150000):strip_icc()/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec.png)

Why Do We Pay Medicare Tax Cares Healthy, Definition and how it works in 2025 fica is a payroll tax that goes toward funding social security and medicare.

Medicare 2025 Updates Abt Insurance, You’re typically responsible for paying half of this amount (1.45%), and your employer is responsible for the other half.

Medicare Advantage Plans 2025 Pdf Fillable Dyane Grethel, Read how this tax works and how it’s calculated.

What is the fica tax rate in 2025? The rate is for both employees and employers, according to the internal revenue code.

Kaiser Medicare Advantage Plans 2025 Cost Britni Hyacinth, The maximum fica tax rate for 2025 is 6.2%.