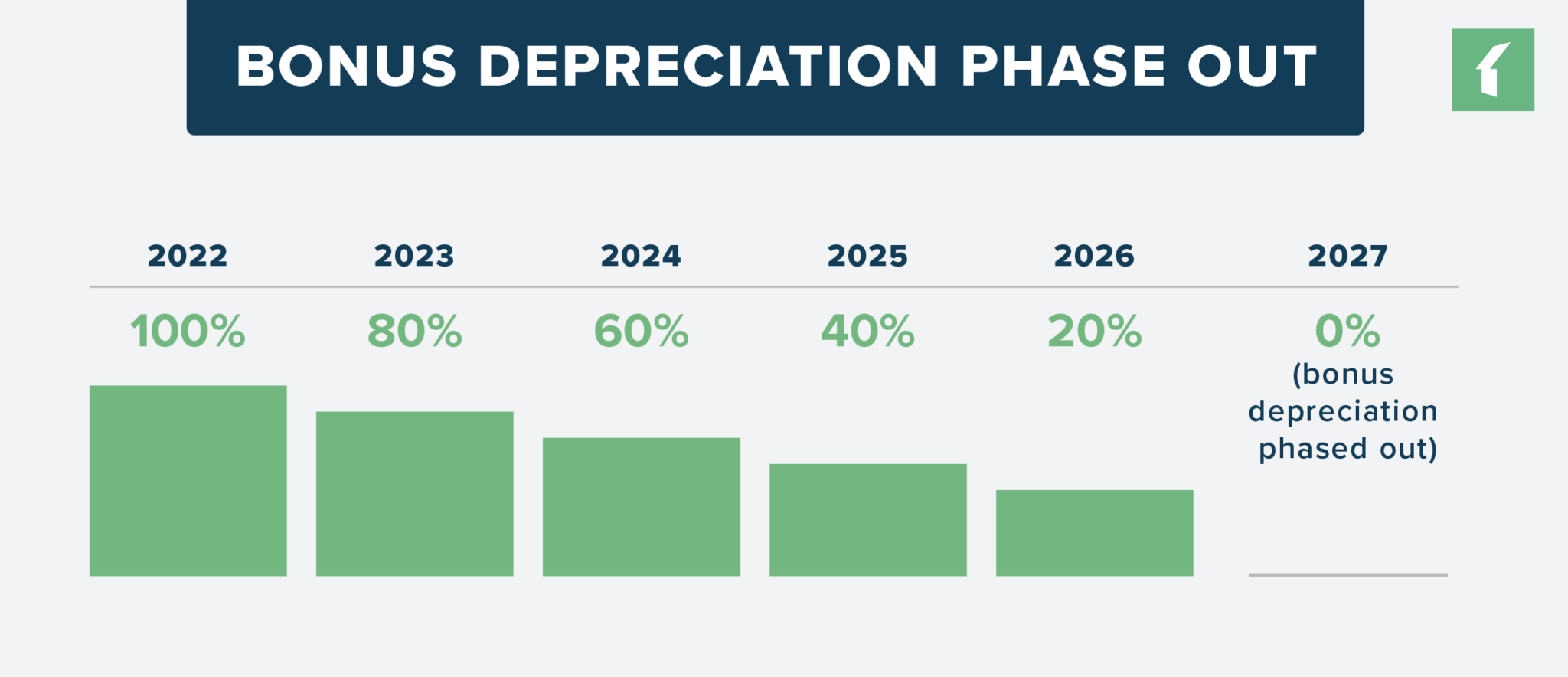

2025 Bonus Depreciation Rate 2025 - Bonus Depreciation 2025 Percentage Change Ted Shantee, Assets acquired during the bonus period (september 27, 2017, to january 1, 2025) can receive. 2025 Bonus Depreciation For Vehicles Caryn Cthrine, The allowable percentage is set to decrease in 20% increments every year through 2027, meaning bonus depreciation is set at 60% for 2025, 40% for 2025, and 20% for 2026.

Bonus Depreciation 2025 Percentage Change Ted Shantee, Assets acquired during the bonus period (september 27, 2017, to january 1, 2025) can receive.

2025 Bonus Depreciation Rates 2025 Wilie Marita, This adjustment means that businesses will no longer be able to deduct.

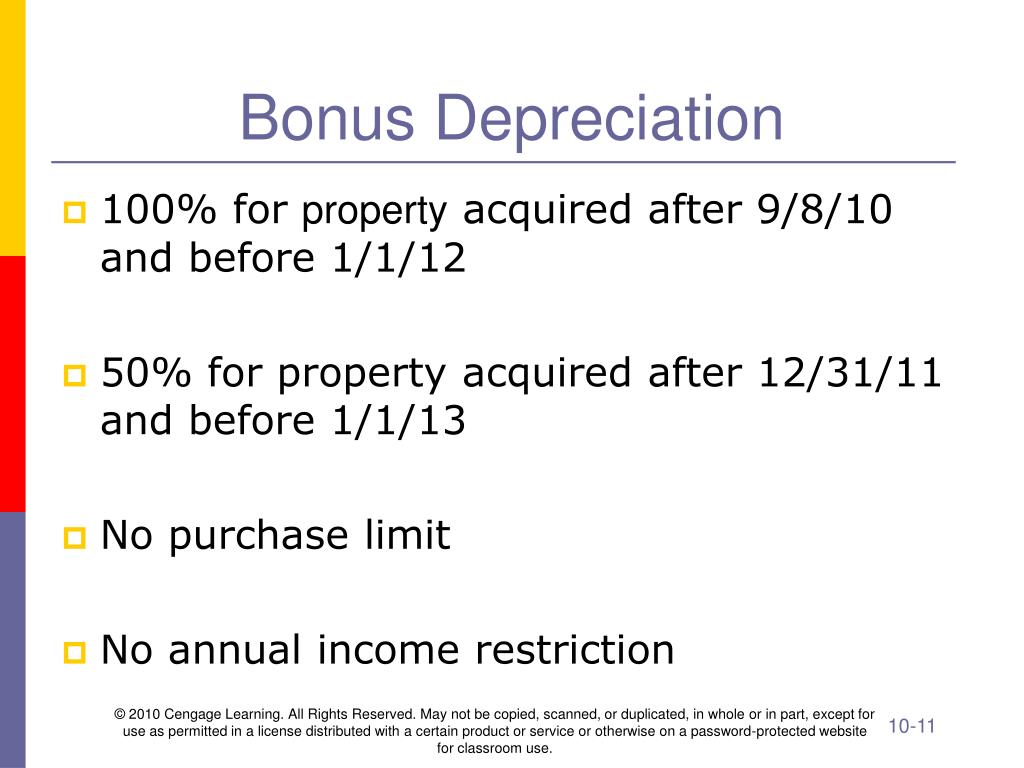

It allows businesses to deduct a significant portion of a purchased asset’s cost in the year. Tax legislation, with 100% bonus depreciation standing out as a.

Bonus Depreciation 2025 Vehicles Over 2025 Grayce Vitoria, It will continue to decrease by 20% each year until it’s.

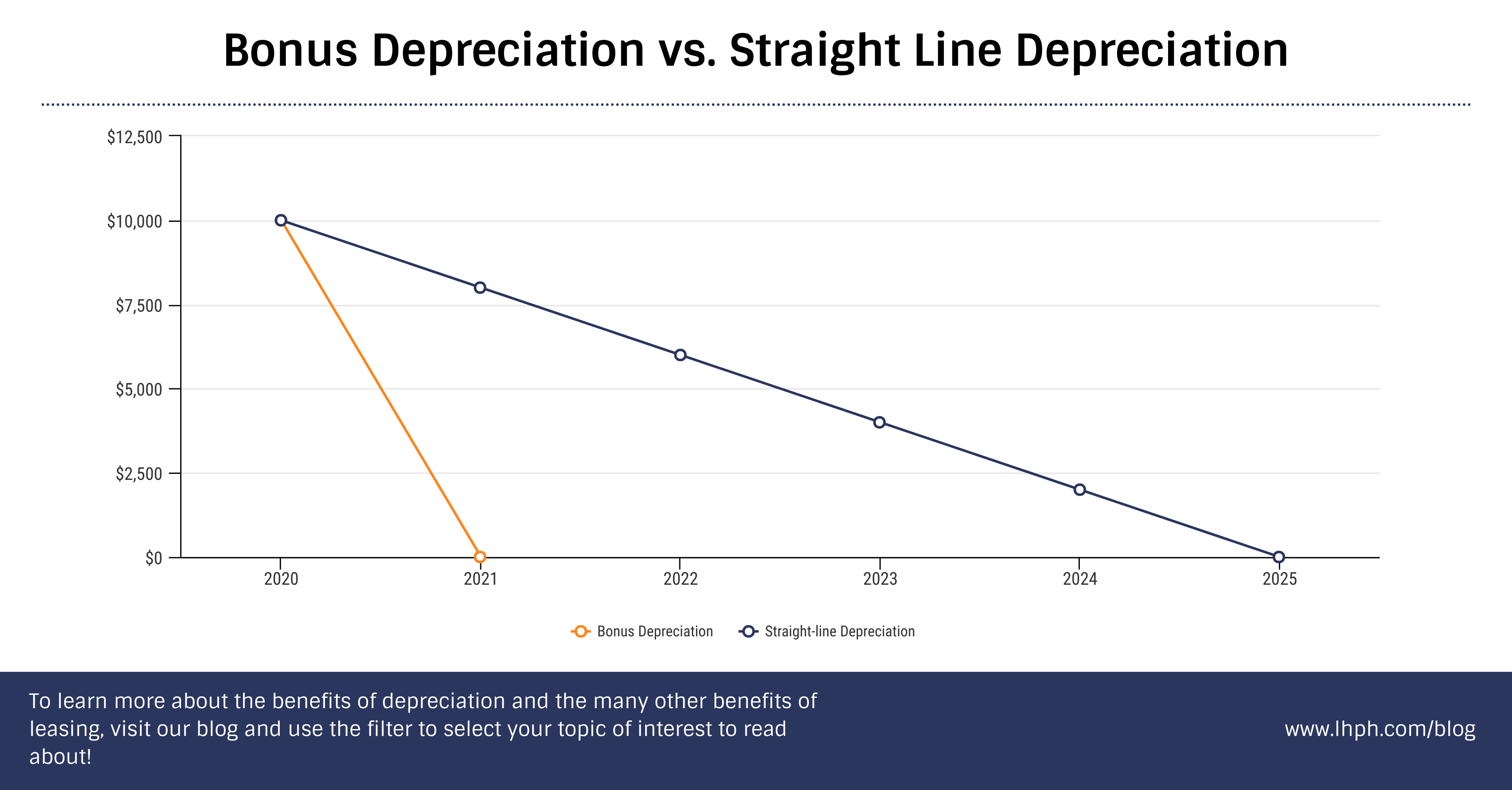

2025 Vehicle Bonus Depreciation Debi Mollie, However, starting in 2025, the rate will drop to 60%.

Solar Bonus Depreciation 2025 Jamima Catharine, In 2025, the bonus depreciation rate was reduced to 80%.

2025 Bonus Depreciation Rates Dannie Kristin, This is down from 80% in 2025.

2025 Bonus Depreciation Rates Jess Romola, In 2025, the bonus depreciation rate will drop to 60%, falling by 20% per year thereafter until it is completely phased out in 2027.

2025 Bonus Depreciation Percentage Calculator Selle Danielle, In 2025, the bonus depreciation rate was reduced to 80%.

2025 Bonus Depreciation Rate 2025. On the other hand, bonus depreciation, particularly under the current laws set to phase down starting in 2025 leading into 2025, allows for a percentage of the cost of qualifying. If we’re in 2025, you can depreciate $6,000 ($10,000 purchase x 0.6 bonus depreciation rate).

2025 Bonus Depreciation Rates Dannie Kristin, Assets acquired during the bonus period (september 27, 2017, to january 1, 2025) can receive.